4-The Economics Behind the Issue

Suicide by Pesticide - The Economics Behind the Issue

There are three possible solutions to help reduce pesticide usage: indirect taxes set by the government, negative advertising to sway public opinion, and government regulations including permits and bans. To analyze the theoretical validity of each solution, we can use the economics concept of market failure.

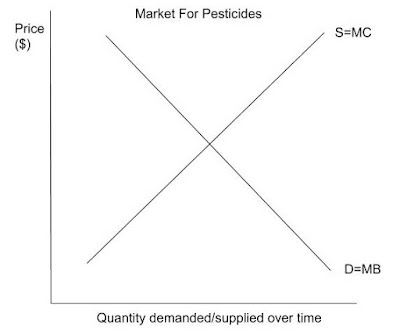

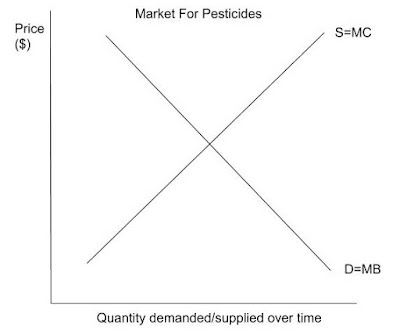

The identity of cost and benefit is important in economics. Marginal cost and marginal benefit is the incremental changes in cost and benefit of producing and consuming one more unit of good (pesticide). The marginal private benefit and cost reflects the benefit and cost of the stakeholders (consumers and producers) while the marginal social benefit and cost involves society as a whole.

On a graph, the marginal benefit is synonymous with demand of the product and is represented by a downward sloping line, while the marginal cost is the supply of the product represented by a upward sloping line.

Sometimes, the private and social benefit are not equal. For example, if consumers eat fish, they are capturing and consuming the private benefit associated with that fish. However, the social benefit of the consumption of fish is less than the private benefit because of negative impacts to the environment. These impacts/effects are called externalities, and they affect a third party (not the consumer nor the producer). In this case, consumers consuming fish would produce a negative externality, as habitat loss and declining coastal ecosystems caused by fishing has a negative impact on society (as a third party), therefore MSB<MPB. Since this externality is caused by consumption of fish, this scenario would be called negative externality of consumption, which also applies to the consumption of pesticides. Externalities caused by the production of a product, like manufacturing of plastics, is known as the negative externality of production. The externality is shown graphically through the blue region of deadweight loss, or loss of social welfare. This happens whenever a market is not producing at allocative efficiency. The DWL could take form of decreased productivity due to health problems caused by pesticides, increased spending on environmental repairs, or increased costs of healthcare.

A market will be at equilibrium (the optimal point, also called allocative efficiency) when the MSB=MSC. At allocative efficiency, the market quantity is Q*, and the market price is P*. (Q*, P*) is the intersection of the MSB and MSC curves.

A market will be at equilibrium (the optimal point, also called allocative efficiency) when the MSB=MSC. At allocative efficiency, the market quantity is Q*, and the market price is P*. (Q*, P*) is the intersection of the MSB and MSC curves.

However, the market is not allowed to reach equilibrium. The consumers only recognize their private benefit of consuming the good and do not see from society's viewpoint. At the allocatively efficient quantity of Q*, the marginal private benefit (benefit that consumer receives) is higher than the marginal private cost (cost that consumer pays), shown by the red arrow. This means that for an additional unit of pesticide consumed, the benefit that the consumer receives is higher than the cost he/she pays. This is true until (Q1,P1). The quantity demanded will be at Q1. Therefore, the producer will increase production to capitalize on the larger consumer demand and produce where MPB=MPC, supply=demand at (Q1,P1).

The market will continue to operate at a production and consumption quantity greater than what is allocatively efficient because consumers only care about their private benefit. This market has failed since it can never reach allocative efficiency without solutions implemented.

Does the above theory apply to the situation of pesticides? Demerit goods are goods or services whose consumption leads to a negative externality of consumption due to their harmful nature to the consumer or society as a whole. A common example is cigarettes, whose consumption leads to health problems that negatively impacts society's healthcare system. The same could be said for pesticides, whose use would cause damage to the environment and create environmental problems, a negative impact to society. So far, the economic theory holds up.

So how do we correct this failure of the market?

We cannot let pesticides continue to be over consumed due to the market failure. There are solutions that government bodies can implement to correct this.

To what extent might the problem of negative externalities of consumption be resolved by the use of negative advertising?

The posters that we created and posted on this blog are perfect examples of negative advertising. The advertisements are meant to sway public opinion. If farmers were pressured or persuaded that pesticides are not the way to go, the demand for pesticides would decrease to be in line with the MSB, decreasing the externality and DWL.

Decreasing the demand would shift the MPB to the left so that MPB=MSB=MSC=MPC. The market is now producing at the allocatively efficient quantity and price (Q*,P*).

Decreasing the demand would shift the MPB to the left so that MPB=MSB=MSC=MPC. The market is now producing at the allocatively efficient quantity and price (Q*,P*).

This solution is already being implemented in the cigarette industry, where packaging contains negative advertisements outlining the health risks of cigarettes. There is also negative advertising against the use of fossil fuels, promoting clean energy sources.

However, this solution is not perfect. It is uncertain whether such advertising would be able to decrease demand of pesticides to such such a desired extent. Consumer dependency is a factor since they may not want to switch to expensive substitutes. Governments may not want to spend money on a solution that may not yield the expected result.

To what extent might the problem of negative externalities of consumption be resolved by the use of government controls?

Our exemplar letter shows how to encourage the PMRA to ban extremely toxic pesticides like neonicotinoids. Banning a good or service essentially shuts down the market for it since it is illegal to purchase and sell the good. It is not advised for the PMRA to ban all pesticides because doing so would force workers (farmers, pesticide producers) out of jobs, cause governments to lose tax revenue, and impact the agricultural yield (which is our food supply). There are no cheap substitutes to pesticides, so banning all would mean increased food prices and creating a new problem. Instead, governments can ban a specific pesticide that is particularly harmful, so farmers still have access to other less toxic alternatives in the market. This also prevents the creation of a black market since there are readily available, cheap substitutes.

Tradable permits and quotas could also be enforced so that farmers are restricted in their use of pesticides. If large corporations are limited in their use of pesticides through permits, they will be more efficient in reducing pesticide use and selling excess permits to other companies for profit. This system is used in the "cap n trade" system where firms are motivated to reduce carbon emissions by selling excess permits for profit. However, the quantity of pesticide use is very hard to track, since it relies on the company self-reporting numbers. Otherwise, it would be expensive for governments to accurately track.

To what extent might the problem of negative externalities of consumption be resolved by the use of indirect taxes?

An indirect tax on pesticides would result in an increased cost of production, as producers will pass on the tax burden to consumers. The MSC curve will shift up and decrease the quantity to the allocative efficient one, Q*, but at a higher market price. The resulting quantity and price is (Q*, P2).

Taxes have already been applied to other demerit goods, such as alcohol, to increase the price of the good and lower demand for it. One critique of the indirect tax is that it may not actually lower demand in some cases. Just like how introducing a tax will not solve addiction for alcohol, adding a tax may cause more problems for farmers who do not have readily available substitutes. They will be forced to buy pesticides at a higher price, potentially creating a black market where the trade of pesticides is not monitored. The price of their product produced will be affected as well, since they have to pass on their economic burden to the consumers of their product. Again, a tax on a specific pesticide could be implemented instead so there are cheaper and less harmful pesticides that can be used while the technology of biopesticides is further developed.

In Conclusion...

In economics, there isn't a perfect solution that will fix everything. The market for pesticides has clearly failed due to the presence of a negative externality of consumption. What actually happens often differs from the theoretical outcome. A combination of the mentioned solutions can be used in conjunction to bring about the desired effect of lowering the quantity of pesticides in the Canadian market.

There are three possible solutions to help reduce pesticide usage: indirect taxes set by the government, negative advertising to sway public opinion, and government regulations including permits and bans. To analyze the theoretical validity of each solution, we can use the economics concept of market failure.

The identity of cost and benefit is important in economics. Marginal cost and marginal benefit is the incremental changes in cost and benefit of producing and consuming one more unit of good (pesticide). The marginal private benefit and cost reflects the benefit and cost of the stakeholders (consumers and producers) while the marginal social benefit and cost involves society as a whole.

On a graph, the marginal benefit is synonymous with demand of the product and is represented by a downward sloping line, while the marginal cost is the supply of the product represented by a upward sloping line.

Sometimes, the private and social benefit are not equal. For example, if consumers eat fish, they are capturing and consuming the private benefit associated with that fish. However, the social benefit of the consumption of fish is less than the private benefit because of negative impacts to the environment. These impacts/effects are called externalities, and they affect a third party (not the consumer nor the producer). In this case, consumers consuming fish would produce a negative externality, as habitat loss and declining coastal ecosystems caused by fishing has a negative impact on society (as a third party), therefore MSB<MPB. Since this externality is caused by consumption of fish, this scenario would be called negative externality of consumption, which also applies to the consumption of pesticides. Externalities caused by the production of a product, like manufacturing of plastics, is known as the negative externality of production. The externality is shown graphically through the blue region of deadweight loss, or loss of social welfare. This happens whenever a market is not producing at allocative efficiency. The DWL could take form of decreased productivity due to health problems caused by pesticides, increased spending on environmental repairs, or increased costs of healthcare.

A market will be at equilibrium (the optimal point, also called allocative efficiency) when the MSB=MSC. At allocative efficiency, the market quantity is Q*, and the market price is P*. (Q*, P*) is the intersection of the MSB and MSC curves.

A market will be at equilibrium (the optimal point, also called allocative efficiency) when the MSB=MSC. At allocative efficiency, the market quantity is Q*, and the market price is P*. (Q*, P*) is the intersection of the MSB and MSC curves. However, the market is not allowed to reach equilibrium. The consumers only recognize their private benefit of consuming the good and do not see from society's viewpoint. At the allocatively efficient quantity of Q*, the marginal private benefit (benefit that consumer receives) is higher than the marginal private cost (cost that consumer pays), shown by the red arrow. This means that for an additional unit of pesticide consumed, the benefit that the consumer receives is higher than the cost he/she pays. This is true until (Q1,P1). The quantity demanded will be at Q1. Therefore, the producer will increase production to capitalize on the larger consumer demand and produce where MPB=MPC, supply=demand at (Q1,P1).

The market will continue to operate at a production and consumption quantity greater than what is allocatively efficient because consumers only care about their private benefit. This market has failed since it can never reach allocative efficiency without solutions implemented.

Does the above theory apply to the situation of pesticides? Demerit goods are goods or services whose consumption leads to a negative externality of consumption due to their harmful nature to the consumer or society as a whole. A common example is cigarettes, whose consumption leads to health problems that negatively impacts society's healthcare system. The same could be said for pesticides, whose use would cause damage to the environment and create environmental problems, a negative impact to society. So far, the economic theory holds up.

So how do we correct this failure of the market?

We cannot let pesticides continue to be over consumed due to the market failure. There are solutions that government bodies can implement to correct this.

To what extent might the problem of negative externalities of consumption be resolved by the use of negative advertising?

The posters that we created and posted on this blog are perfect examples of negative advertising. The advertisements are meant to sway public opinion. If farmers were pressured or persuaded that pesticides are not the way to go, the demand for pesticides would decrease to be in line with the MSB, decreasing the externality and DWL.

Decreasing the demand would shift the MPB to the left so that MPB=MSB=MSC=MPC. The market is now producing at the allocatively efficient quantity and price (Q*,P*).

Decreasing the demand would shift the MPB to the left so that MPB=MSB=MSC=MPC. The market is now producing at the allocatively efficient quantity and price (Q*,P*).

This solution is already being implemented in the cigarette industry, where packaging contains negative advertisements outlining the health risks of cigarettes. There is also negative advertising against the use of fossil fuels, promoting clean energy sources.

However, this solution is not perfect. It is uncertain whether such advertising would be able to decrease demand of pesticides to such such a desired extent. Consumer dependency is a factor since they may not want to switch to expensive substitutes. Governments may not want to spend money on a solution that may not yield the expected result.

To what extent might the problem of negative externalities of consumption be resolved by the use of government controls?

Our exemplar letter shows how to encourage the PMRA to ban extremely toxic pesticides like neonicotinoids. Banning a good or service essentially shuts down the market for it since it is illegal to purchase and sell the good. It is not advised for the PMRA to ban all pesticides because doing so would force workers (farmers, pesticide producers) out of jobs, cause governments to lose tax revenue, and impact the agricultural yield (which is our food supply). There are no cheap substitutes to pesticides, so banning all would mean increased food prices and creating a new problem. Instead, governments can ban a specific pesticide that is particularly harmful, so farmers still have access to other less toxic alternatives in the market. This also prevents the creation of a black market since there are readily available, cheap substitutes.

Tradable permits and quotas could also be enforced so that farmers are restricted in their use of pesticides. If large corporations are limited in their use of pesticides through permits, they will be more efficient in reducing pesticide use and selling excess permits to other companies for profit. This system is used in the "cap n trade" system where firms are motivated to reduce carbon emissions by selling excess permits for profit. However, the quantity of pesticide use is very hard to track, since it relies on the company self-reporting numbers. Otherwise, it would be expensive for governments to accurately track.

To what extent might the problem of negative externalities of consumption be resolved by the use of indirect taxes?

An indirect tax on pesticides would result in an increased cost of production, as producers will pass on the tax burden to consumers. The MSC curve will shift up and decrease the quantity to the allocative efficient one, Q*, but at a higher market price. The resulting quantity and price is (Q*, P2).

Taxes have already been applied to other demerit goods, such as alcohol, to increase the price of the good and lower demand for it. One critique of the indirect tax is that it may not actually lower demand in some cases. Just like how introducing a tax will not solve addiction for alcohol, adding a tax may cause more problems for farmers who do not have readily available substitutes. They will be forced to buy pesticides at a higher price, potentially creating a black market where the trade of pesticides is not monitored. The price of their product produced will be affected as well, since they have to pass on their economic burden to the consumers of their product. Again, a tax on a specific pesticide could be implemented instead so there are cheaper and less harmful pesticides that can be used while the technology of biopesticides is further developed.

In Conclusion...

In economics, there isn't a perfect solution that will fix everything. The market for pesticides has clearly failed due to the presence of a negative externality of consumption. What actually happens often differs from the theoretical outcome. A combination of the mentioned solutions can be used in conjunction to bring about the desired effect of lowering the quantity of pesticides in the Canadian market.